Utube Qb Refund Customer and Make Invocie Active Again

In QuickBooks, if yous are using the QuickBooks payments so you lot have to enter and then process the credit bill of fare payments. This way the accounting kept authentic, elementary, and like shooting fish in a barrel.

Sometimes, you are required to procedure the QuickBooks credit card refund payments for the items that your customer returned. Below, yous get to know how y'all can process a refund in QuickBooks Online and how to procedure a refund in QuickBooks online and how to enter a refund into QuickBooks Desktop.

Save Fourth dimension, Reduce Errors, and Improve Accuracy

Dancing Numbers helps small businesses, entrepreneurs, and CPAs to do smart transferring of data to and from QuickBooks Desktop. Utilize import, consign, and delete services of Dancing Numbers software.

How to Procedure for Credit Card Refund in QuickBooks online?

There are many different ways that you tin can implement to refund a Credit Carte payment to your customer. You can refund the payment to the customer for a paid invoice or a sales receipt. So the partial payment can also be initiated to the customer according to the requirements.

What are the Requirements to Process QuickBooks Credit Card Refund?

There are some requirements that you must know about before processing the QuickBooks credit menu refund procedure. These requirements are every bit follows:

- The refund can be initiated up to the amount of the sale that is original simply not more than that.

- The credit carte refund can be issued within 180 days of the sale that yous take done to the customer.

- Refund of credit card is initiated to the source card or business relationship that was used for the payment at the time of purchase. For this, yous are required to connect with your customer to get the details.

What are the Steps to Perform a QuickBooks Credit Card Refund?

In that location are three things on which you can perform a QuickBooks credit menu refund. these three iii things are bill of fare receipt, edelweiss, and fractional refund. And then, you have to follow the step-by-stride procedure co-ordinate to the category and which you want to initiate the refund from Your QuickBooks Online account.

Here are the steps that you can perform according to the Scenario that you lot are going to perform for a credit card refund. the scenarios with the detailed steps are mentioned beneath:

Credit Card Refund for Sales Receipt

In case of making a refund for the receipt into your QuickBooks account then you have to create a refund receipt. for creating the refund receipt, you are required to cull the customer mention the payment method, and then relieve the details. for processing the refund to a bank or credit menu, yous have to follow the post-obit steps:

- Open QuickBooks Online.

- Click on the + New button.

- Select the option Refund receipt.

- Hit on the driblet-downwardly arrow of the Customer field.

- Cull the Customer to whom you desire to refund for credit card.

- Then mention the required details.

- You lot have to Add the details same as the original sales to process the refund.

- In example if you are looking forrard to crediting back the credit carte; so go to the Payment method and click on the Credit card option.

- Now from the section Refund from, you lot have to choose the Payment Method and too the Account from which you want to refund your client.

- When you are washed with all the above steps, then click on the Save and Shut button.

By following these steps, the QuickBooks credit card refund for sales receipt is candy and will exist sent to the client. After that, you lot tin can take the print of the refund that you have washed by clicking on the print push.

Credit Carte du jour Refund for Paid Invoice

In case of paid invoices by your customers yous are looking for a refund then you accept to create the refund receipt. While creating the dissimilar receipts, you have to cull your customer, mention the required details for the refund, and select the payment method, and save the details.

- In your Windows system.

- Open up the QuickBooks Online into the browser.

- Login to your QuickBooks account.

- And then on the dwelling page, click on the New + button.

- Choose the option Refund Receipt.

- In refund receipt, click on the Customer drop-down arrow.

- Choose the Client to whom you lot want to initiate of credit card refund.

- You have to add the details that are required at the time of credit menu refund.

- While adding the details make sure that the details are the same every bit the original sale that you had done before.

- You lot have to select the account from which y'all want to refund your client from the department refund from.

- Likewise, select the Payment method from which you lot are going to pay the refund of credit menu.

- In the end, click on the Salvage and Close push button when you are all gear up.

- The refund process of a credit card into your QuickBooks online account is initiated and can exist done soon.

Subsequently processing the QuickBooks credit card refund, you lot tin impress the refund candy bye by clicking on the push named print.

Ship a Partial Refund

In case of a partial refund, you lot have to create a new refund receipt, choose the customer for a refund, provide all the details, and then send the partial refund. Information technology is sent for particular items, products, or services. To send a refund partially the detailed steps are every bit follows:

- Click on the New button having a + sign.

- From driblet-down options, click on the Refund Receipt option.

- Click on the drop-down arrow of the Customer field.

- Cull the customer to whom y'all want to requite the refund.

- Enter the details that are required for the refund and make certain that the details are the same got into the sale details you accept done.

- In the end, click on the Save and Close button.

In case of partial refund, you accept to add the amount and the items for which we are going to procedure the QuickBooks credit bill of fare refund. After that, you tin can print the refund received by clicking on the print button.

How to Enter a Credit Card Refund on QuickBooks Desktop?

In QuickBooks Desktop, if you are processing the refund Then you can do it with a cash payment or checks. the payment is done to the credit card of the customer. the QuickBooks payments accept care of all the processes in case y'all are refunding or credit card.

There are ii ways to refund the payment for a credit carte du jour in QuickBooks Desktop. That refunding processes are:

- Refund is done for all amounts of specific services or products

- A refund is done for the partial amount.

Few Requirements for Credit Bill of fare Refund in QuickBooks Desktop

- Check and verify that you have refunded the amount of the original transaction inside 6 months.

- The credit card tin can be refunded that was used for the original auction.

- The Merchant business relationship or company Auth ID must exist the same as used for the original transaction by the user.

- The credit card refund amount must not be more than than the original candy amount.

What are the Steps for QuickBooks Desktop Refund Credit Menu Payment?

The steps for QuickBooks Desktop refund credit carte payment are mentioned below:-

- First of all, open the QuickBooks Desktop on your system

- Then login to the QuickBooks payments and your desktop software

- Click on the Customer card selection

- Further, select the Credit Memos or Refunds option

- To choose the customer click on the Customer: Task drop-down menu

- At present select the Client from the drop-downwardly menu for whom yous are processing this refund

- You have to add together the product and services for which you are going to initiate the refund

- Later that, click on the button Save and Close

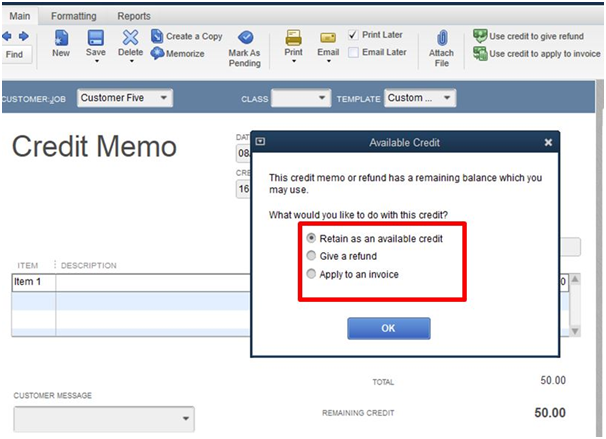

- It opens up the window of Available Credit

- In this window, click on the Give a refund option

- So click on the OK button to proceed further

- If you want to give credit for future payment so you have to choose the pick "Retain as available credit"

- Click on the OK button to proceed farther

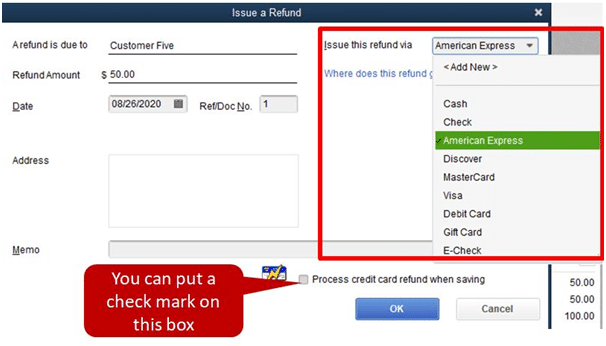

- After that, If the "Issue a Refund" window opens up so you can determine How to refund the transaction. This transaction can be refunded using the "Issue the Refund via" field. In this, yous have to choose the payment method that is cash or check. So choose the account for which you are processing the refund.

- For the payment of credit card you lot have to mention the following details that are as follows:

- Click on the "Result this refund via" field

-

- Then click on the type of credit card you desire to refund for

- Add the details of the credit card or you can also swipe the credit card using the Swipe card selection

- And so tick marker the checkbox named Process credit carte du jour refund

- When you are washed with all the higher up steps then click on the OK push button.

- Now QuickBooks process the refund and handles the full accounting process on its own.

How and When do Customers Receive their Credit Carte Refunds?

At that place is one question that customers wondering about it is when they receive their money back from the bank. So, it happens within seven to x business days. In this period, customers receive their credit carte refunds. QuickBooks applies only refunds and credits to the credit card or debit carte of the customer when the petals latest transaction batch at 3:00 p.m. PT each day. After all, it depends on different when a client reviews the credit as the standard time is between 7 to ten days.

What are the Means to Categorize the Credit Card Refund from the Vendor?

Different means are in that location to categorize the credit card refund from the vendor. If you receive a credit card refund from the vendor so y'all have to categorize them and add together them to the ledger. After that, you have to create a vendor credit and then apply information technology to the beak. Hither is the procedure that you have to follow for a QuickBooks credit card refund from the vendor:

Create the Vendor Credit

For categorizing the QuickBooks credit carte du jour refund from the vendor, yous have to create the vendor credit. After creating the Vendor Credit, y'all can hands apply it to the pecker by inbound the detail name and category details properly. So to create the vendor credit the steps are:

- Open the QuickBooks software

- And then click on the New + button

- From the options displayed, select the Vendor Credit option

- You have to cull the vendor from the Vendor drop-down menu

- Choose the option for how you want to record purchases with your vendor

- Two options are "Item details" or "Category details". And then, you take to choose or make full in whatsoever one of the details to record the data

- Click on the Salvage and Close button

- Now, yous are washed with creating the vendor credit into your QuickBooks Desktop account.

Use the Vendor Credits to the Bill

When you are done with creating the vendor credits then apply them to the bill. To apply information technology, you have to choose the option Pay Bills, then select the bill for the vendor, and mention the required fields. The steps to apply vendor credit to the bill in QuickBooks are as follows:

- Open your QuickBooks account

- On the homepage, click on the New button that is shown every bit + sign

- At present choose the pick Pay Bills

- You have to select the bill from the list for the vendor

- The available credit in the Credit Applied field with Vendor

- You take to Enter the details in the remaining that are shown on your screen

- Make sure that all the information is correct then that credit bill of fare refunds tin exist practical easily.

How the Credit Card Refund Procedure can be done in QuickBooks online?

Later creating and applying for the credit card refund, you tin easily be processed into your QuickBooks Online business relationship. To procedure the ready you just have to cull the refund received option, at the customer name, select the category type of credit card, and so at the required details for the refund. to do this in a proper manner the detailed steps are mentioned here:

- From QuickBooks homepage

- Click on the New that is + plus icon

- Further, select the Refund Receipt from the drop-down options

- Mention the name of the client in the Customer Field or selected from the drop-downward list of customers

- Choose the blazon of credit card that is used past the customer

- Tick mark the option named Process Credit Card

- Choose the service or product that must exist the same every bit the sales service or product

- Now select the predefined amount that is the same every bit the original sale corporeality

- Mention all the required fields to process the refund

- Click on the Save and Close push button.

How many Means are in that location to Record Credit Card Refunds in QuickBooks?

To record the credit carte refund or refund to the customer yous have to brand sure that you have done the post-obit things. these things are life creating the credit memo, write a check with the refund amount, and link the credit memo to the check. This helps yous cannot open up the refund checks are credit memos that are not Linked and applied. The process to tape credit menu refunds in QuickBooks is as follows:

Create the Credit Memo

- Open the QuickBooks program

- Then click on the Client Menu choice

- From farther options, select the Create a Credit Memo

- Then you have to click on the Client: the situation

- Mention all the details that are required for the credit memo

- In the finish, striking on the button named Save and Close.

Write Checks with the Full Amount of Refund

- In QuickBooks Online, go to the left navigation bar

- Select the Banking pick

- Click on the Write Checks pick

- Choose the Bank Account in which you desire to post the check you are writing

- Click on the field "Pay to the gild of"

- So add the name of the customer

- Mention the Total Amount of refund or credit

- Add together the "Credit Memo numbers" in the department of the Memo

- Switch to the tab named Expenses

- In the Account column, select the selection Accounts Receivable

- Mention the name of the customer and the amount for refund

- Click on the Save and Close button.

Link Credit Memo to your Bank check

- Get to the Customer menu pick in QuickBooks

- From further options, select the pick Receive payments

- Now in the Received From field

- Click on the Customer selection

- Choose the Discounts and Credits pick

- In the section of Available Credits, you have to choose the check that you just created

- Click on the Done button

- In the terminate, when you are done, click on the Salve and Shut button.

In decision, you get to know no how a QuickBooks credit carte refund tin exist initiated. the credit menu refund tin be done in both the software whether you are using QuickBooks Online or QuickBooks desktop. Too, you become to know how to do, procedure, and record credit carte du jour refunds from your QuickBooks account.

In case if you are facing whatsoever problems while processing the refund or whatever other problem then connect with the Dancing Numbers team. the squad is here to assist you all the time whenever required every bit they are bachelor 365 days a year. y'all but accept to connect with the team and get the solutions and answers for all your queries, doubts, errors, issue, or bug.

Accounting Professionals, CPA, Enterprises, Owners

Looking for a professional expert to get the right aid for your problems? Here, we have a squad of professional and experienced team members to set up your technical, functional, data transfer, installation, update, upgrade, or information migrations errors. Nosotros are hither at Dancing Numbers bachelor to assist you with all your queries. To fix these queries y'all can get in touch on with us via a toll-free number

+i-347-428-6831 or chat with experts.

Go With QuickBooks Credit Menu Refund Video Tutorial

What tin can exist Washed instead of the QuickBooks Credit Card Refund Process?

You lot can void the transaction co-ordinate to the situation. Here are the details that let you lot know when y'all can void the transaction:

If the payment is not candy then yous can void the transaction then you will avoid the fee.

If the payment is not candy then yous can void the transaction then you will avoid the fee.

If the payment transaction has non been batched then you tin can easily void the transaction.

If the payment transaction has non been batched then you tin can easily void the transaction.

Brand sure to practice it before three:00 PM PT equally every batch is done at this time on every business day.

Brand sure to practice it before three:00 PM PT equally every batch is done at this time on every business day.

Are at that place whatever Requirements to Fulfill before Entering or Processing the QuickBooks Credit Bill of fare Refund?

Yes, there are some requirements mention above whether you do a credit carte refund in QuickBooks Desktop or Online. These requirements are important to have care of to avoid whatever issues, issues, or errors while processing the refund of credit carte from QuickBooks account.

Features of Dancing Numbers for QuickBooks Desktop

Imports

Exports

Deletes

Customization

Supported Entities/Lists

Dancing Numbers supports all QuickBooks entities that are mentioned below:-

Customer Transactions

| Invoice |

| Receive Payment |

| Estimate |

| Credit Memo/Render Receipt |

| Sales Receipt |

| Sales Lodge |

| Argument Charge |

Vendor Transactions

| Neb |

| Bill Payment |

| Purchase Order |

| Item Receipt |

| Vendor Credit |

Banking Transactions

| Check |

| Periodical Entry |

| Deposit |

| Transfer Funds |

| Bank Statement |

| Credit Card Statement |

| Credit Bill of fare Accuse |

| Credit Card Credit |

Employee Transaction / List

| Time Tracking |

| Employee Payroll |

| Wage Items |

Others

| Inventory Aligning |

| Inventory Transfer |

| Vehicle Mileage |

Technical Details

Piece of cake Process

Bulk import, export, and deletion can be performed with simply ane-click. A simplified procedure ensures that you will be able to focus on the cadre work.

Fault Free

Worried nearly losing time with an mistake prone software? Our error gratuitous add-on enables you to focus on your work and boost productivity.

On-time Back up

We provide round the clock technical assist with an assurance of resolving any issues inside minimum turnaround fourth dimension.

Pricing

Importer, Exporter & Deleter

*Run into our Pricing for upwardly to iii Visitor Files

$199/- Per Year

Pricing includes coverage for users

- Services Include:

- Unlimited Consign

- Unlimited Import

- Unlimited Delete

Accountant Basic

*See our Pricing for up to 10 Visitor Files.

$499/- Per Year

Pricing includes coverage for users

- Services Include:

- Importer,Exporter,Deleter

- Unlimited Users

- Unlimited Records

- Upto 10 companies

Auditor Pro

*See our Pricing for up to 20 Company Files.

$899/- Per Year

Pricing includes coverage for users

- Services Include:

- Importer, Exporter, Deleter

- Unlimited Users

- Unlimited Records

- Up to xx companies

Accountant Premium

*See our Pricing for upwardly to 50 Company Files.

$1999/- Per Twelvemonth

Pricing includes coverage for users

- Services Include:

- Importer, Exporter, Deleter

- Unlimited Users

- Unlimited Records

- Up to l companies

Often Asked Questions

How and What all can I Consign in Dancing Numbers?

You need to click "Outset" to Export data From QuickBooks Desktop using Dancing Numbers, and In the export process, you need to select the blazon you desire to consign, like lists, transactions, etc. Later on that, apply the filters, select the fields, so practise the export.

You can export a Chart of Accounts, Customers, Items, and all the available transactions from QuickBooks Desktop.

How can I Import in Dancing Numbers?

To use the service, yous accept to open both the software QuickBooks and Dancing Numbers on your organization. To import the data, you lot have to update the Dancing Numbers file so map the fields and import information technology.

How tin I Delete in Dancing Numbers?

In the Delete process, select the file, lists, or transactions you want to delete, then employ the filters on the file and then click on the Delete choice.

How can I import Credit Menu charges into QuickBooks Desktop?

Start of all, Click the Import (Start) bachelor on the Habitation Screen. For selecting the file, click on "select your file," Alternatively, you can also click "Browse file" to scan and cull the desired file. You can also click on the "View sample file" to go to the Dancing Numbers sample file. Then, prepare the mapping of the file column related to QuickBooks fields. To review your file data on the preview screen, just click on "side by side," which shows your file data.

Which file types are supported by Dancing Numbers?

XLS, XLXS, etc., are supported file formats past Dancing Numbers.

What is the pricing range of the Dancing Numbers subscription Plan?

Dancing Numbers offers iv varieties of plans. The well-nigh popular one is the basic program and the Auditor basic, the Auditor pro, and Auditor Premium.

How tin can I contact the customer service of Dancing Numbers if any issue arises after purchasing?

We provide you support through dissimilar channels (Email/Chat/Phone) for your bug, doubts, and queries. Nosotros are always available to resolve your issues related to Sales, Technical Queries/Issues, and ON boarding questions in real-time. You tin can even get the benefits of anytime availability of Premium support for all your problems.

How can I Import Price Level List into QuickBooks Desktop through Dancing Numbers?

First, click the import push on the Home Screen. And then click "Select your file" from your system. Next, set upward the mapping of the file column related to the QuickBooks field. Dancing Numbers template file does this automatically; you lot only need to download the Dancing Number Template file.

To review your file data on the preview screen, just click on "next," which shows your file data.

What are some of the features of Dancing Numbers to be used for QuickBooks Desktop?

Dancing Numbers is SaaS-based software that is like shooting fish in a barrel to integrate with any QuickBooks account. With the aid of this software, you lot tin import, consign, too as erase lists and transactions from the Visitor files. Also, you can simplify and automate the process using Dancing Numbers which will help in saving time and increasing efficiency and productivity. Just fill in the data in the relevant fields and utilise the appropriate features and it's done.

Furthermore, using Dancing Numbers saves a lot of your time and money which yous can otherwise invest in the growth and expansion of your business. Information technology is free from any human errors, works automatically, and has a vivid user-friendly interface and a lot more than.

Why should practice y'all change the Employee status instead of deleting them on QuickBooks?

If you are unable to see the option to terminate an employee on your list of active employees on the company payroll, this by and large implies that they have some history. Thus, if you change the employee condition instead of deleting information technology on QuickBooks, the profile and pay records remain in your bookkeeping database without whatsoever data loss in your tax payments.

Is it possible to use the Directly Connect option to sync bank transactions and other such details between Bank of America and QuickBooks?

Yeah, absolutely. You can use the Direct Connect Option by enrolling for the Directly Connect service which will allow you access to the small business online banking selection at bankofamerica.com. This characteristic allows yous to share bills, payments, information, and much more.

Why should practice y'all modify the Employee status instead of deleting them on QuickBooks?

If you are unable to see the option to finish an employee on your list of active employees on the company payroll, this more often than not implies that they have some history. Thus, if you change the employee status instead of deleting it on QuickBooks, the profile and pay records remain in your bookkeeping database without any information loss in your tax payments.

What are the various kinds of accounts you could access in QuickBooks?

QuickBooks allows you to access almost all types of accounts, including but not express to savings business relationship, checking account, credit card accounts, and money market accounts.

Go Back up

Bulk import, export, and deletion can be performed with simply one-click. A simplified process ensures that yous will be able to focus on the cadre work.

Worried about losing time with an error prone software? Our error free add together-on enables you to focus on your piece of work and boost productivity.

Source: https://www.dancingnumbers.com/quickbooks-credit-card-refund/

0 Response to "Utube Qb Refund Customer and Make Invocie Active Again"

Post a Comment